nj tax sale certificate

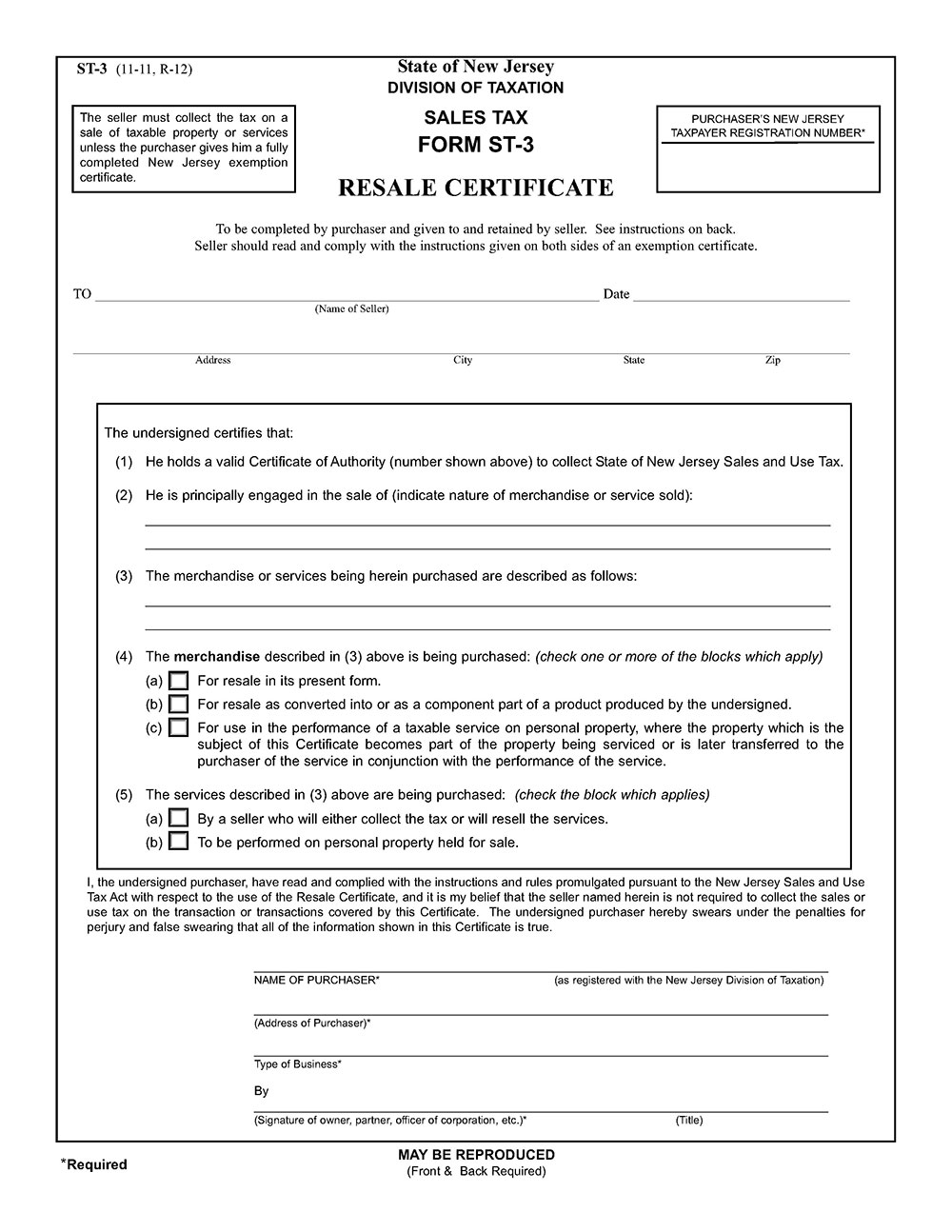

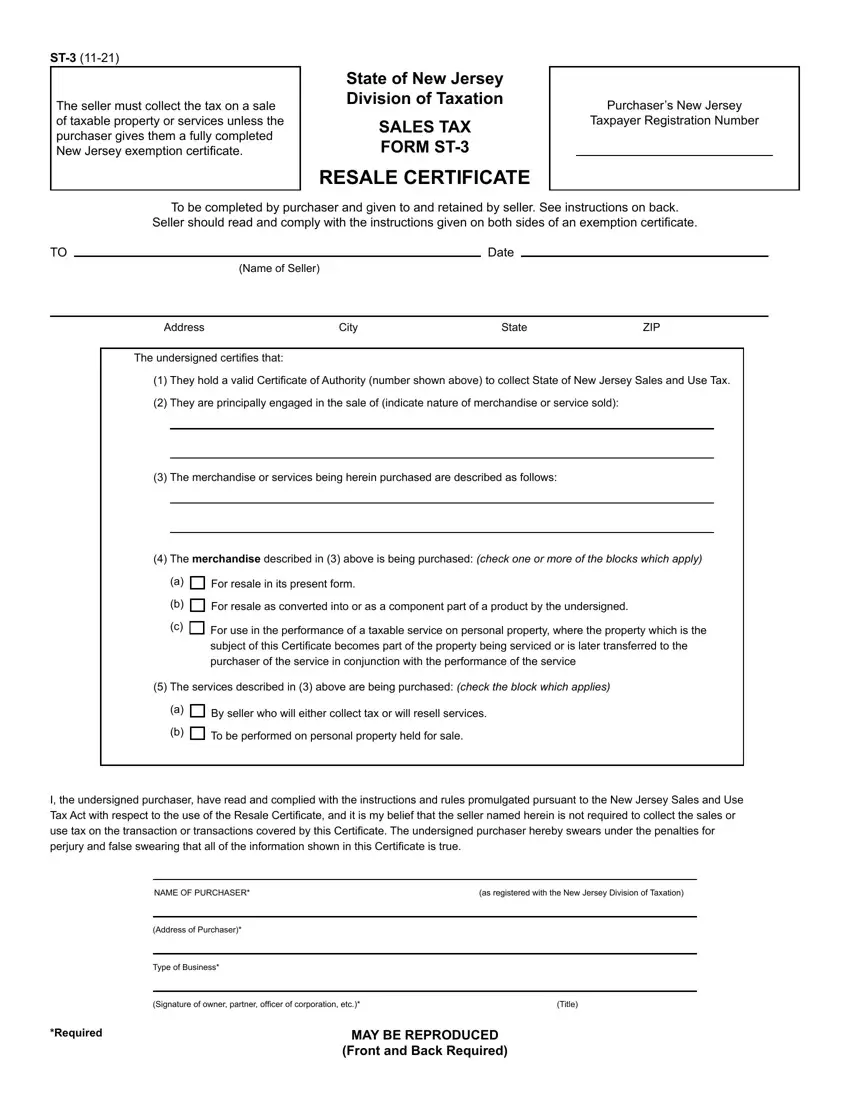

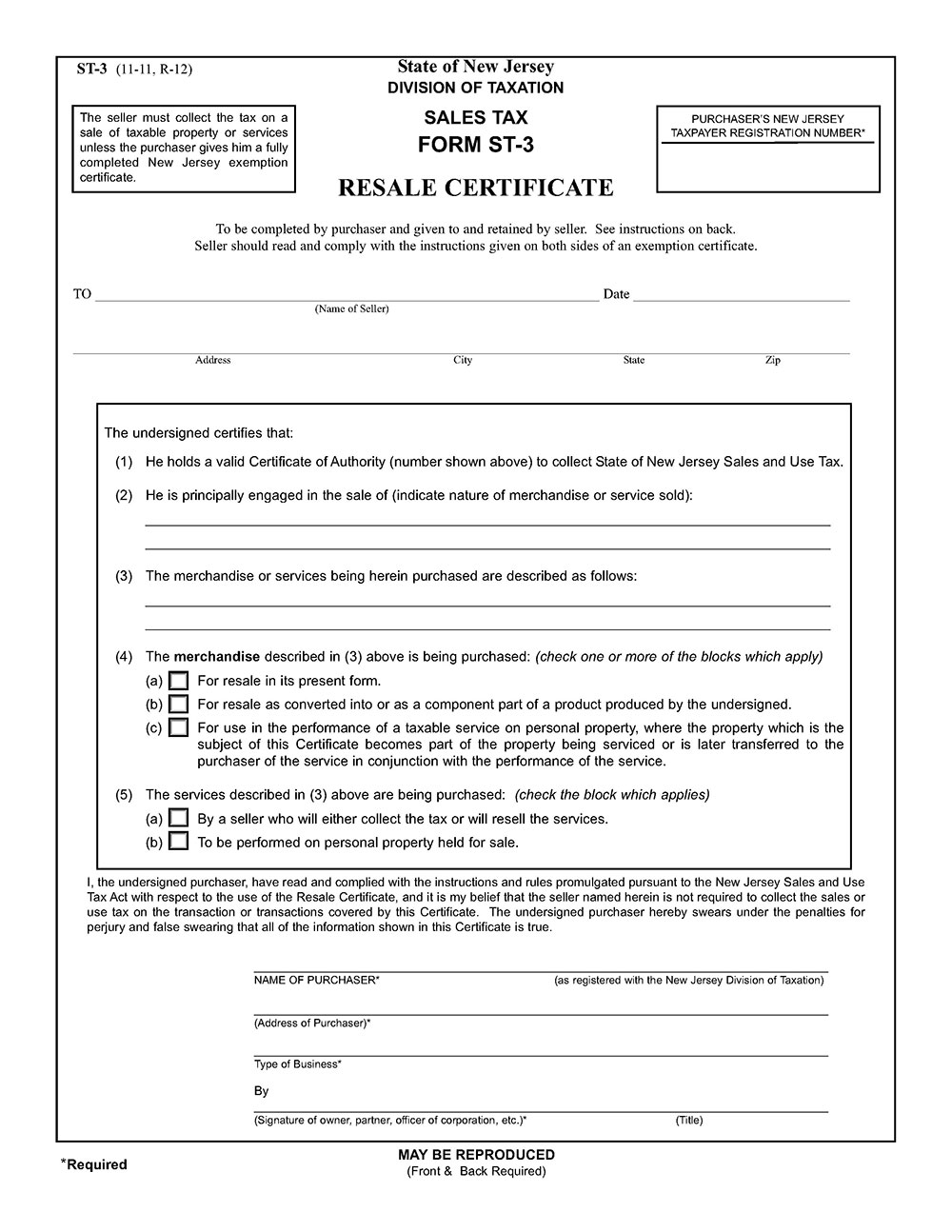

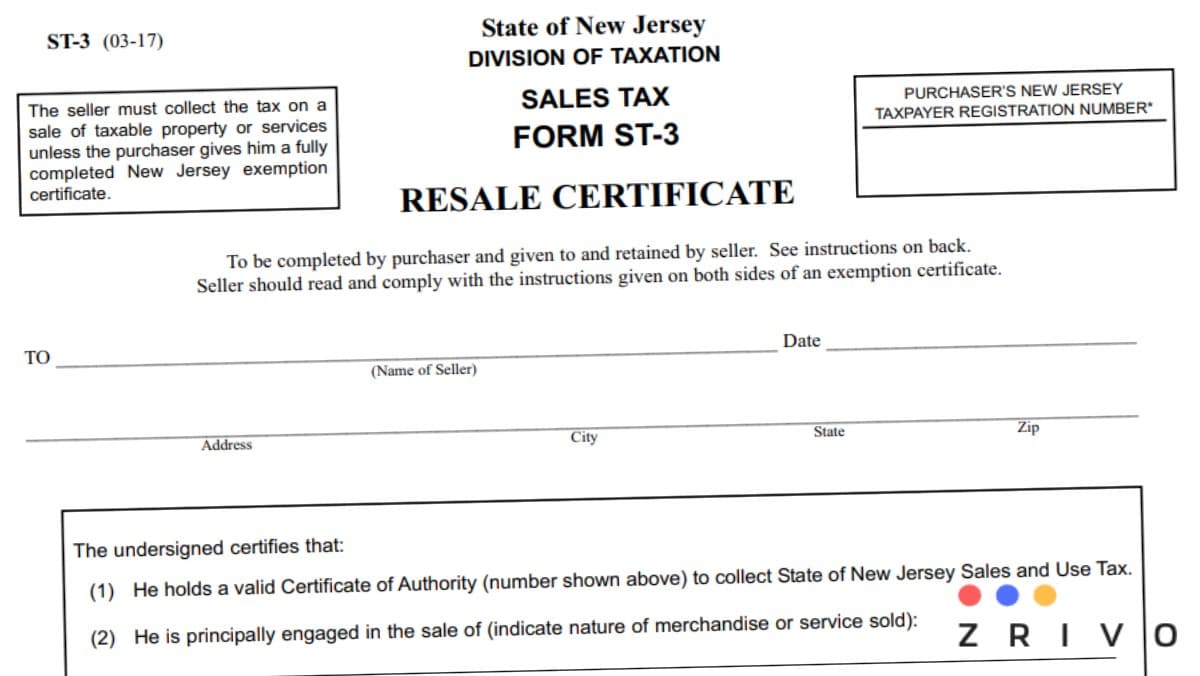

The sales tax certificate is obtained through the New Jersey Division of Revenue and Enterprise Services as a part of applying for the New Jersey Business Registration NJ-REG. Steps for filling out the ST-3 New Jersey Resale Certificate.

Form Nj 165 Download Fillable Pdf Or Fill Online Employee S Certificate Of Non Residence In New Jersey New Jersey Templateroller

Foreclosure right of redemption recording of final judgment.

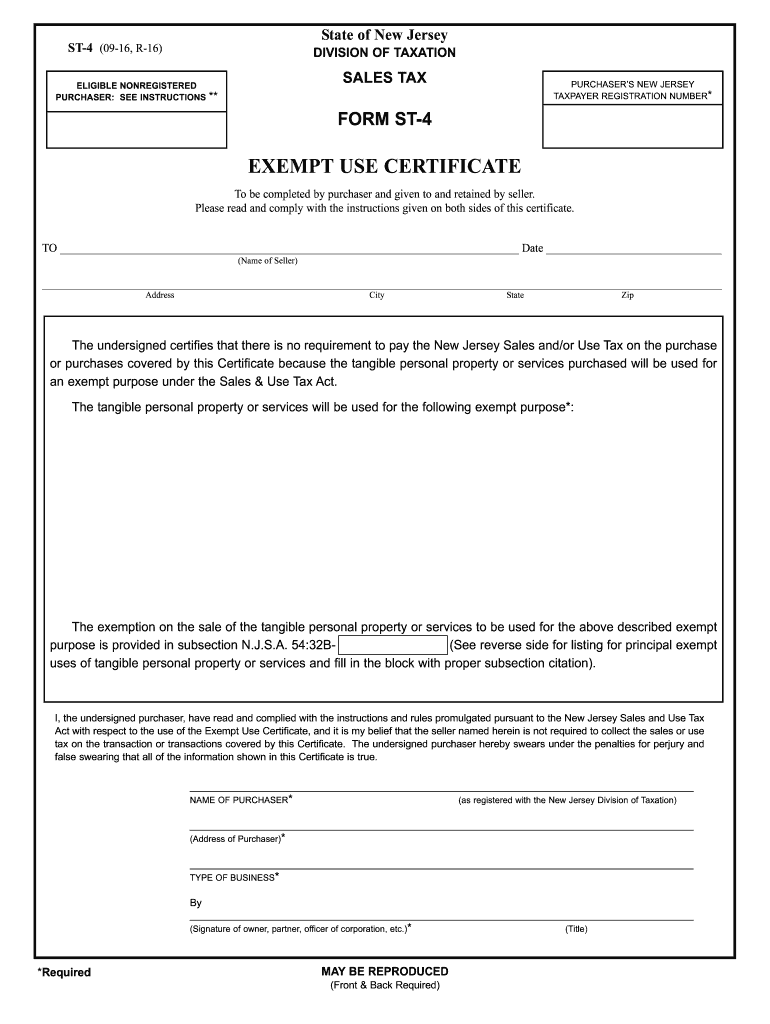

. Step 2 Identify the name and business address of the seller. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases. You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to.

This certificate will furnish a business with a unique NJ sales tax number otherwise referred to as a NJ Tax ID number. Tax Sale Certificate Basics All owners of real property are required to pay both property taxes and any other municipal charges. Every New Jersey municipality is authorized by statute to conduct public tax sales due to the non-payment of real estate taxes by the property owner.

The municipality will issue a tax sale certificate to the purchaser who then must pay the real estate taxes for a minimum of 2 consecutive years as a condition precedent to filing suit to foreclose the lien. Step 4 List the merchandise or services being purchased. After July 1 2017 any applicant for certification that cant obtain a Premier Business Services.

These payments are added to the tax sale certificate. Tax delinquent properties are advertised in a local newspaper prior to the municipal tax sale. New Jersey Tax Lien Auctions.

This legislation establishes requirements for publication of notice issuance of notice to the property owner bidder registration conducting the online tax lien sale as. Methods of sale of certificate of tax sale by municipality. Step 3 Describe the nature of merchandise or service of the buyer.

Instead the winner of the Tax Sale Certificate now has a lien against the property in the amount paid for the Tax Sale Certificate plus interest and penalties which will continue to accrue. New Jersey is a good state for tax lien certificate sales. By selling off these tax liens municipalities generate revenue.

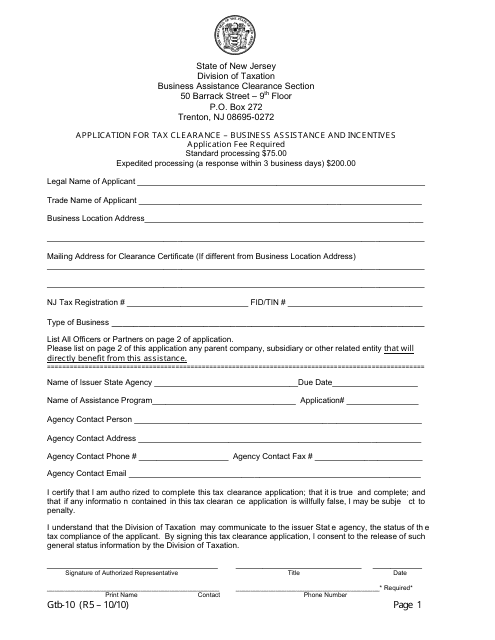

This registration allows a business to not only register to. Business Tax Clearance Certification Required for Receiving State Grants Incentives. This is commonly referred to as a sellers permit sales tax permit sales tax license sales tax number or sales tax registration.

Anyone wishing to bid must register preceeding the tax sale. As the task of collecting sales tax falls on the business that makes the sales and not the consumer any failure to remit. Purchasers of tax sale certificates liens.

Step 1 Begin by downloading the New Jersey Resale Certificate Form ST-3. These are known as subsequent payments. Sale of certificate of tax sale liens by municipality.

Here is a summary of information for tax sales in New Jersey. If a bid made at the tax sale meets the legal requirements of the Tax Sale Law the municipality must either sell the lien or outbid the bidder. Interest rates at the auctions start at 24 and can eventually be bid down to zero.

Sale of certificate of tax sale liens by municipality. Tax sales are conducted by the tax collector. February 1 May 1 August 1 and November 1.

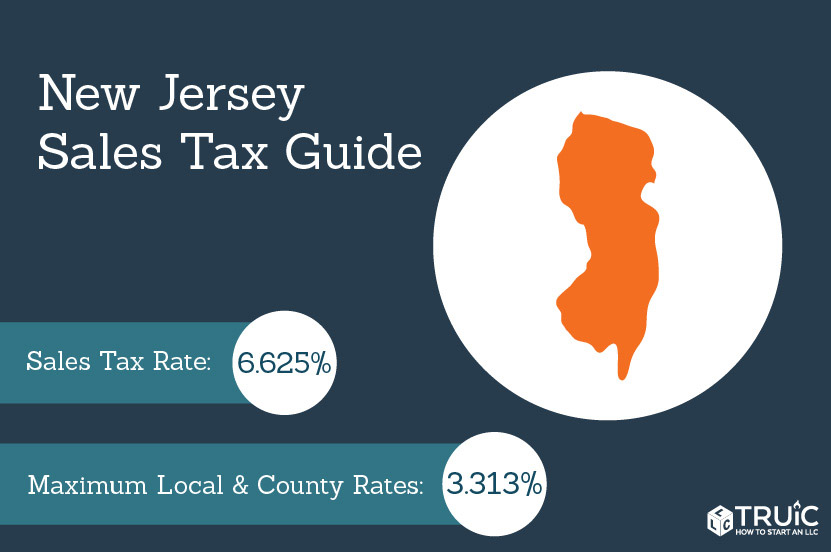

Electronic Municipal Tax Sales Online LFN 2018-08 Adoption of NJAC 533-11 creating regulations for long standing PILOT program for internet-based tax sales. This is your permit to collect Sales Tax and to use Sales Tax. It allows suppliers to know that you are legally allowed to purchase the.

A New Jersey resale certificate also commonly known as a resale license reseller permit reseller license and tax exemption certificate is a tax-exempt form that permits a business to purchase goods from a supplier that are intended to be resold without the reseller having to pay sales tax on them. As a seller of taxable goods or services you are required to be registered with the New Jersey Division of Revenue and Enterprise Services. 545-1 to -137 a purchaser of a tax sale certificate acquires a tax lien not a lien securing the property owners obligation to pay the amount owing to redeem the certificate.

Thus when you pay your taxes. 30 rows Sales and Use Tax. New Jersey Tax Sale Certificate Foreclosure is a Tax Lien Foreclosure A property owner faces losing his or her property once he or she stops making tax.

The municipalities sell the tax liens to obtain the tax revenue which they should have been paid by the property owner. In New Jersey property taxes are a continuous lien on the real estate in the full annual amount as of the 1stof the year. How to use sales tax exemption certificates in New Jersey.

18 or more depending on penalties. The New Jersey Supreme Court in In re. Third parties and the municipality bid on the tax sale certificates TSC.

The municipal tax collector conducts the sale which allows third parties and the municipality itself to bid on the tax sale. 0024-0000 Tax Sale Certificates Copy and Register---A tax sale certificate is a recorded lien against the property for an outstanding levy. What if I Sell Taxable Goods or Services in New Jersey.

Tax liens are also referred to as tax sale certificates. Plymouth Park Tax Services LLC determined that under the Tax Sale Law NJSA. The lien holder has the right anytime a payment falls delinquent to pay the charges due to the municipality.

Once registered you must display your Certificate of Authority for Sales Tax Form CA-1 at your business location. Princeton Office Park LP. Buyers appear at the tax sale and purchase the tax sale certificates by paying the back taxes to the municipality.

After the tax sale certificate has been issued the lien holder now has the right to pay any delinquent municipal charges that have not gone to sale. Dates of sales vary depending on the municipality. Property taxes are payable in four installments.

By posting this notice the State of New Jersey neither recommends nor discourages investment in tax sale certificates and makes no guarantee of profit or positive result from such investment. At the conclusion of the sale the highest bidder pays the outstanding. Tax sale certificates require active follow up and management by the investor.

Tax Sale Certificates are recorded in County Clerks Office. PURCHASERS NEW JERSEY CERTIFICATE OF AUTHORITY NUMBER The undersigned certifies that there is no requirement to pay the New Jersey Sales andor Use Tax on the purchase or purchases covered by this Certificate because the tangible personal property or services purchased will be used for an exempt purpose under the Sales Use Tax Act. However if someone would like to purchase them they must contact the Municipal Tax Assessors office in the city of interest.

All municipalities in New Jersey are required by statute to hold annual sales of unpaid real estate taxes. In New Jersey tax lien certificates are sold at each of the 566 municipal Tax Sales. New Jersey offers grants incentives and rebates to businesses and every recipient must obtain a business assistance tax clearance certificate from the Division of Taxation.

The holder of a New Jersey Tax Sale Certificate does not own the property. Sales subject to current taxes. Further additional assignments recorded.

It is essential to know that obtaining a NJ Certificate of Authority is one of the first steps a business owner should take when starting a business. In New Jersey every municipality is required by law to hold sales of unpaid property taxes at least once each year.

New Jersey Division Of Taxation Letter Sample 1

Form Gtb 10 Download Fillable Pdf Or Fill Online Application For Tax Clearance Business Assistance And Incentives New Jersey Templateroller

Furniture Bill Of Sale How To Create A Furniture Bill Of Sale Download This Furniture Bill Of Sale Bill Of Sale Template Bill Of Sale Car Business Template

Form St 3 New Jersey Fill Out Printable Pdf Forms Online

Will You Get A Break On Your N J Property Taxes During Coronavirus Crisis Nj Com

New Jersey Sales Tax Small Business Guide Truic

How To Get A Resale Certificate In New Jersey Startingyourbusiness Com

Moving With Gloribee Moving Selling House Closing Costs

Nj St 4 2016 2022 Fill Out Tax Template Online Us Legal Forms

Gloucester City Tax Sale Information Gloucester City Nj

New Jersey Resale Certificate Trivantage

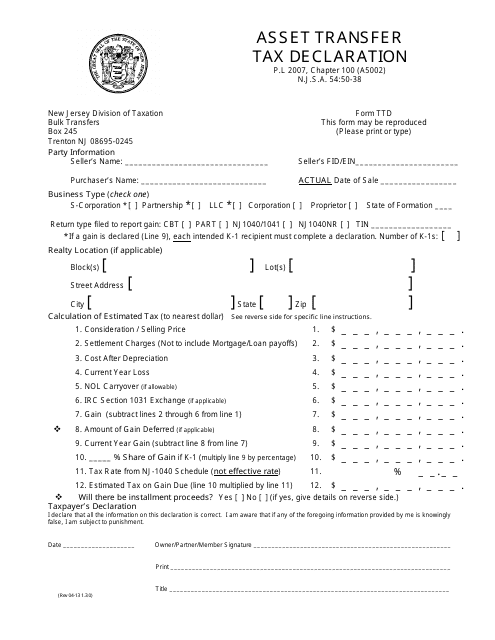

Form Ttd Download Printable Pdf Or Fill Online Asset Transfer Tax Declaration New Jersey Templateroller

How To Register For A Sales Tax Permit In New Jersey Taxvalet

St3 Form Nj 2021 Sales Tax Zrivo

How To Register For A Sales Tax Permit In New Jersey Taxvalet